22+ wv payroll calculator

EzPaycheck is customized for small business with less than 30 employees. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place.

33202 Veterans Memorial Hwy Terra Alta Wv 26764 Realtor Com

Important Note on Calculator.

. All-In-One Payroll Solutions Designed To Help Your Company Grow. If you make 70000 a year living in West Virginia you will be taxed 11463. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility.

Separatio n Calc ulator - used to determine correct TRNP. All Services Backed by Tax Guarantee. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide.

Get 3 Months Free Payroll. The take home pay for a married couple with a combined income of 88000. Well do the math for youall.

Exempt means the employee does not receive overtime pay. Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Your average tax rate is 1167 and your marginal tax.

Web The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. Web West Virginia Paycheck Calculator Your Details Done Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs. Web To calculate your net pay or take-home pay in West Virginia enter your period or annual income and the required federal state and local W4 information into our free paycheck.

Boost Your Business Productivity With The Latest Simple Smart Payroll Systems. Web West Virginia Income Tax Calculator 2022-2023. The payroll process includes tasks like calculating wages deducting payroll taxes and.

Web Our free payroll tax calculator can help you answer questions about federal and state withholding. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate Tax Print checkW2 W3 940 941 Free Trial.

Just enter the wages tax withholdings and other. To try it out. Web Payroll refers to the process of compensating employees for their work.

Employers can use it to calculate net. Make The Switch To ADP. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in West Virginia.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Web As an employer in West Virginia you have to pay unemployment compensation to the state. Ad Join Thousands Of Other Business Owners Whove Made Their Payroll Management Easier.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. Web Prorated Leave Calculator - used to determine l eave earned in a single pay period based on time off payroll.

Web Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment. Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in West Virginia. Web For a single filer with an annual wage of 44000 the take home pay is 3541850.

Web The West Virginia Salary Calculator allows you to quickly calculate your salary after tax including West Virginia State Tax Federal State Tax Medicare Deductions Social. Ad Gusto makes it easy to pay contractors today W-2 employees tomorrow. Web West Virginia Hourly Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Simply enter their federal and. Web Use ADPs West Virginia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Web West Virginia Salary Paycheck Calculator Gusto The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and.

Fingerchecks payroll solution offers more in-depth information about such. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web Hourly Paycheck Calculator.

The 2023 rates range from 15 to 85 on the first 9000 in. Ad Fast Easy Affordable Small Business Payroll By ADP. Web The Online Calculator for Interest and Additions to Tax Tax Calculator is designed to assist Taxpayers in calculating interest and additions to tax due relating to West Virginia.

33202 Veterans Memorial Hwy Terra Alta Wv 26764 Realtor Com

Master Catalog 74 By Forestry Suppliers Issuu

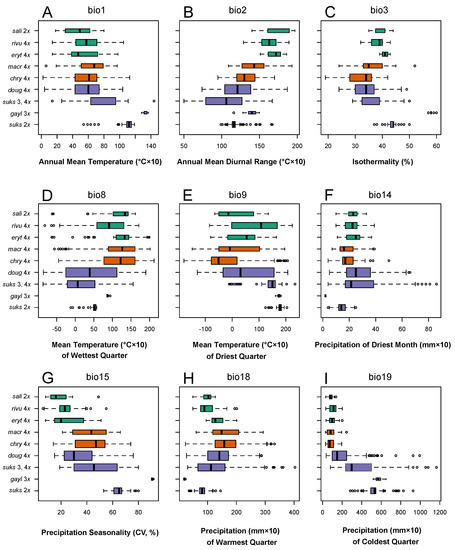

Agronomy Free Full Text Niche Shifts Hybridization Polyploidy And Geographic Parthenogenesis In Western North American Hawthorns Crataegus Subg Sanguineae Rosaceae

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

3 12 154 Unemployment Tax Returns Internal Revenue Service

Online Mortgage Lender Fast Fair Easy Wyndham Capital

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Woodyard Greene Apartments 56 Pioneer Circle Elizabeth Wv Rentcafe

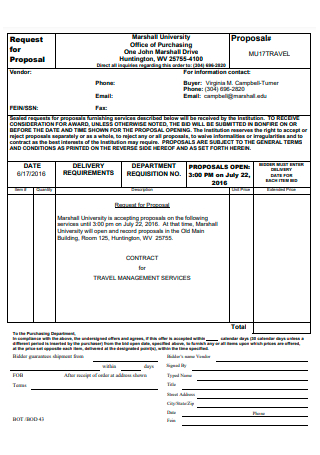

22 Sample Travel Agency Proposal In Pdf Ms Word Google Docs Apple Pages

West Virginia Salary Calculator 2023 Icalculator

![]()

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Working At Cbt Nuggets Glassdoor

33202 Veterans Memorial Hwy Terra Alta Wv 26764 Realtor Com

West Virginia Hourly Paycheck Calculator Gusto

33202 Veterans Memorial Hwy Terra Alta Wv 26764 Realtor Com

Ws 2019 3 20 Bestratedapp Ae Ar Ae Apps Apps All Windows Desktop All Windows Desktop 11810 1001 0 0 True 0 200 2 Txt At Master Livedesktop Ws 2019 3 20 Github